Due Diligence – What You Need to Know

Due diligence is an essential process in mergers and acquisitions. It is also beneficial when making investment or funding decisions. In summary, due diligence is a comprehensive appraisal of a business to sanity check decisions, uncover unknown information, and mitigate risks.

The two main types are buy-side and sell-side due diligence. Buy-side is instigated by the potential purchaser, investor, or funder to investigate the company that is the subject of the transaction.

The company that is the subject of a merger or acquisition can also conduct due diligence on itself. This is often referred to as sell-side due diligence. It enables the subject of a merger or acquisition to identify and address issues that might prevent the transaction from failing at a later date. Sell-side due diligence might also uncover a different fair market value for the business than was otherwise thought.

Due Diligence Objectives

The due diligence process can have specific objectives based on the transaction and parties involved. The main objectives that apply to the majority of situations include:

- Identify issues that could be deemed as deal breakers.

- Challenge the decision-making process, including testing the information used to make decisions and value the transaction.

- Identify weaknesses and risks that might not be considered deal breakers but are important to be aware of before a final decision is made on whether or not to complete the transaction.

- Contribute to the negotiation process, especially in highlighting uncovered challenges, weaknesses, and risks. The due diligence process could also determine a different market value for the business in question. This information can also be used in negotiations.

- Identify areas where additional guarantees or warranties are needed to make the proposed transaction more robust and commercially viable and to mitigate risks.

Examples of the things that can be uncovered as part of a due diligence process include ongoing legal claims, outstanding debts, and employee issues. Due diligence could also uncover the company is the wrong cultural or operational fit for your business or investment requirements.

Hard and Soft Due Diligence Considerations

Due diligence covers financial, legal, operational, asset, and employee elements. The process should involve investigating and analysing both hard and soft considerations.

Hard due diligence considerations are things like accounting numbers and similar data.

Soft considerations are not as easily quantifiable, but they are still critical. Soft due diligence considerations include people, relationships, leadership, and corporate culture, i.e., factors that cannot be summed up in a number or graph. Both hard and soft due diligence are important, although the soft aspects are not always given the attention they deserve.

What is Investigated in a Due Diligence Process

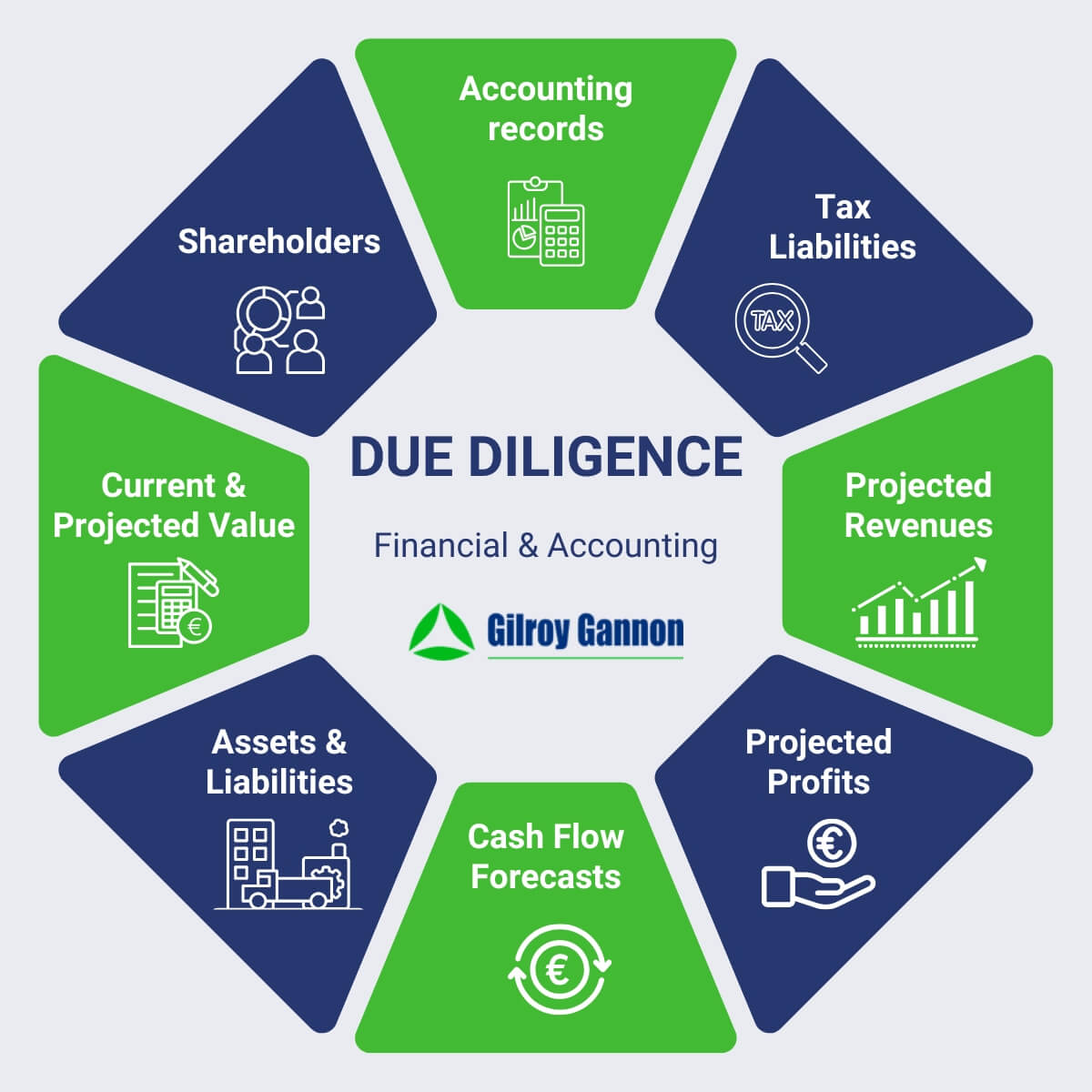

Financial and Accounting

- Current and historical accounts, including audited financial statements, balance sheets, and profit & loss reports.

- Accounting policies such as depreciation and amortisation

- Tax liabilities

- Projected revenues

- Projected profits

- Cash flow forecasts

- Assets and liabilities

- Shareholders, ownership percentages, and share values

- Current value

- Commercial potential and projected value

Business and Operations

- Production processes and KPIs.

- Suppliers, supplier contracts, and the strength of the supply chain.

- Management and staff, including skills and capabilities as well as views, engagement rates, and levels of employee satisfaction.

- Employee and HR considerations, including organisation charts, head counts, employee contracts, job roles, salaries, benefits, and staff retention rates.

- Compliance and legal issues and potential future considerations.

- Intellectual property and trademarks.

- Marketing and sales strategies with a specific emphasis on customer satisfaction and brand perception.

- Commercial standing, such as type of customer, customer spread, inclusion on approved supplier lists, etc.

- IT issues, including IT infrastructure health, cybersecurity robustness, and annual maintenance costs.

- Business and trading risks and weaknesses, covering both internal and external factors.

Overview of the Due Diligence Process

Various methods are used to conduct due diligence on a company. This includes investigations and analysis that don’t require cooperation from the subject company. However, cooperation from the subject company is almost always essential to ensure the conclusions reached are robust, accurate, and complete.

As a result, due diligence typically involves investigations at the company’s location to review files, processes, and procedures, and to talk with management and staff.

The overall process usually requires a broad range of skills and expertise to complete, including accounting, IT, finance, HR, and business expertise.

The end result is typically a report that describes the findings of the investigation and analysis. The report will include:

- Significant findings such as potential deal breakers.

- Issues (risks, weaknesses, etc) and points that can be used during negotiations.

- Other issues that will need to be addressed after the transaction has been completed.

The aim of the report is to provide business leaders with factual, data-focused information and analysis that can then be used to make both the next steps and final decisions.

Due Diligence Support

One point that hasn’t been addressed so far in this blog is who conducts due diligence. In almost all situations, the best approach is to involve outsourced due diligence experts. There are two main reasons for this:

- Outsourced due diligence experts will have the expertise and experience across a broad range of fields to ensure a robust and complete process.

- Outsourced due diligence experts will be impartial investigators and analysts. This means they will be focused on cold, hard facts, regardless of the perceived attractiveness of the potential deal.

At Gilroy Gannon, we have extensive due diligence experience. Our team of experts covers multiple disciplines including financial, accounting, legal, business, and IT. Please get in touch to discuss your due diligence requirements.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.