Key Considerations When Restructuring a Business in Ireland

Businesses are restructured for various reasons, from dealing with the most difficult of challenges to taking advantage of growth opportunities and everything in between. There are also various ways to restructure a business in Ireland, with some more complex than others.

As a result, there are a number of factors to consider. These factors will ensure you stay on the right side of tax and company law as well as helping maximise success.

Common Reasons for Restructuring a Business in Ireland

- Mitigating risks such as market, competition, regulatory, or legal risks.

- Overcoming financial difficulties such as refinancing company debt.

- Addressing other business and operational challenges, such as reorienting the business to better serve changing customer requirements.

- Separating out businesses or assets.

- Adding value and/or making the business more competitive.

- Making the structure more appropriate for the needs of the business. For example, the initial structure of a start-up company can become unsuitable once the business grows. Restructuring in this situation will enable the business to move to the next level of growth.

- Making the business a more attractive acquisition target and/or taking pre-emptive steps to streamline a potential acquisition transaction.

- Resolving a business dispute and/or improving alignment between financial stakeholders.

- Succession planning.

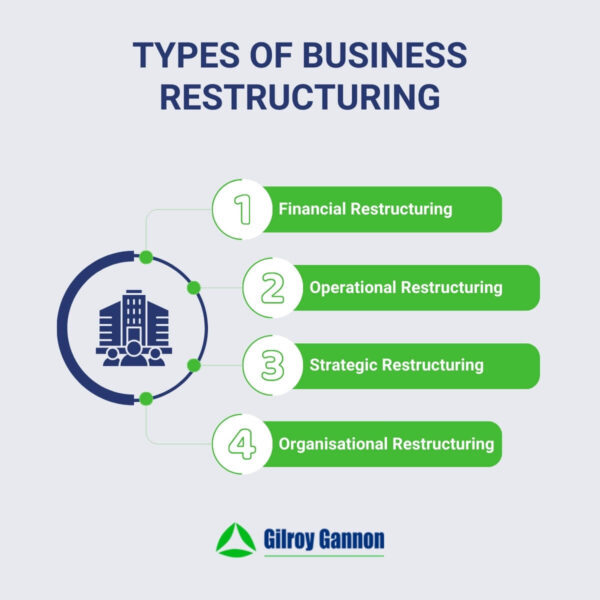

Common Types of Restructuring Processes

Common options for restructuring a business include changing the legal structure or changing the owners. The latter could be through a merger or acquisition, or through succession planning. In these situations, it might be necessary to transfer or reorganise shares, reorganise capital, and/or transfer assets.

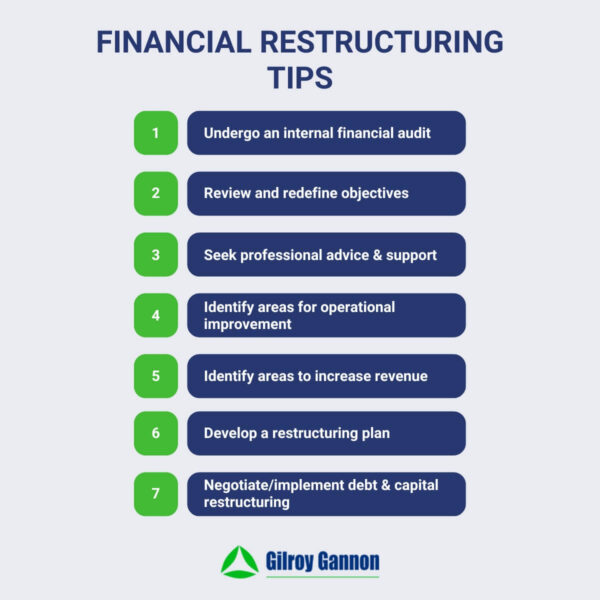

Financial restructuring is another common approach, particularly when a business is facing financial challenges. Financial restructuring can give the business the space and time it needs to move beyond the financial challenges and become more stable.

Changing operational processes is another common approach to business restructuring. This often applies as a result of market forces, where the aim is typically to make the business more competitive.

The Benefits of Restructuring a Business

- Make the business more efficient and productive

- Establish a more stable financial position for the business

- Reduce costs

- Improve leadership

- Increase customer confidence

- Better equip the business for future success

The Challenges of Restructuring a Business

Many of the challenges that can arise when restructuring a business are situation-specific. Some of the more common challenges include:

- Market perception, especially with customers or key partners who might have concerns about the restructuring plans.

- Loss of talent either as a direct result of the restructuring process (i.e., redundancies) or by key resources choosing to leave.

- Reduced staff confidence and morale that could go on to affect productivity, innovation, and performance.

Almost all challenges when restructuring a business can be overcome or significantly mitigated with proper planning and support from third-party experts.

Considerations When Restructuring a Business

Tax

What are the tax consequences of the restructuring now and in the future? Are the restructuring plans tax compliant and has the strategy been optimised to ensure it is as tax efficient as possible? Getting the right tax advice is essential.

Legal

Are there any potential legal issues and what steps should be taken to ensure compliance? What legal processes have to be followed? Are any of the steps restricted under the Companies Act? Examples of restricted activities include reducing the share capital or the variation of share capital on a re-organisation. Where a restricted activity applies, there are typically two main options:

- Go to the Irish High Court to seek consent

- Use the more streamlined summary approval procedure (SAP)

Getting the right legal advice is also essential.

Implementation

One of the first stages is to define the new structure for the business. It is also important to outline the steps required to complete the restructuring process. It is usually best to include legal, financial, and operational audits as part of this process, in addition to considering stakeholder engagement, communication, milestones, and due diligence.

Employees

How will the restructuring process impact employees and what steps need to be taken? Does TUPE apply? TUPE refers to the Transfer of Undertaking (Protection of Employment) Regulations 2006. It most commonly applies when a business is being sold and involves transferring an employer’s obligations to its employees to the new owners.

Other stakeholders

How will other stakeholders, such as customers, partners, or suppliers, be affected by the restructuring? What steps need to be taken to ensure the transition is as smooth as possible?

Operations

What operational aspects of the business will be affected? This includes bank accounts, contracts, consents from third parties such as landlords or lenders, licences, communication methods (email addresses for example), marketing, etc.

All Aspects Covered

Restructuring a business usually involves a number of technical components, such as share reorganisations or dealing with the courts. There can also be operational components, and there are almost always human elements that need to be properly planned for and managed.

Getting the right support is essential, and we can help at Gilroy Gannon. Get in touch today to discuss your requirements.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.