Accounting vs Bookkeeping – Understanding the Difference

Does your business need accounting services, bookkeeping services, or both? It is a common question, particularly for start-ups and businesses going through a rapid growth phase. Understanding the difference between accounting and bookkeeping will help you make the right decision for your business and ensure you get the support you need.

Both accounting and bookkeeping are essential tasks in business. A confusing element is that there are many overlaps in terms of tasks and responsibilities, i.e., a bookkeeper could offer services generally categorised under accounting while accountancy firms commonly also offer bookkeeping services.

As a summary, bookkeeping is an essential part of accounting, but both are important.

What is Bookkeeping?

Bookkeeping is about ensuring the financial records of your business are up to date and properly organised. Bookkeeping services will also commonly look after some financial tasks essential to the running of your business.

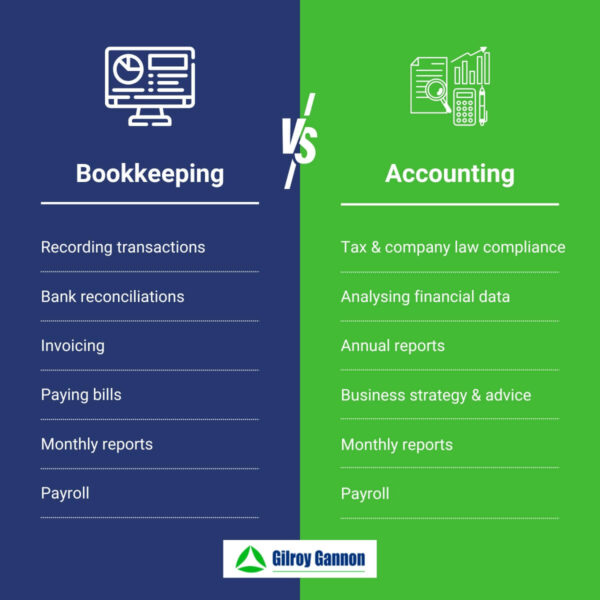

Common bookkeeping tasks and responsibilities include:

- Recording financial transactions, including sales, invoices, purchases, and payments.

- Ensuring records are accurate and correctly categorised.

- Paying bills.

- Reconciling bank statements as a quality control process to ensure transactions are recorded accurately.

- Preparing some financial reports such as income statements and balance sheets.

Bookkeepers are also often a source of advice and guidance for business owners given their detailed knowledge of the current financial position of the company.

What is Accounting?

Accounting is about understanding the financial performance of your business. This includes analysing the current financial position of your business and its potential future financial position to help with decision-making.

Accounting services can be quite broad in scope and also include very specialised services (forensic accounting and statutory audits are two examples). However, common accounting tasks that all businesses need include:

- Reporting and interpreting financial information.

- Analysing financial data and identifying trends.

- Preparing financial reports for business owners.

- Ensuring compliance with accounting standards, company law, and tax regulations.

- Providing advice and guidance to business owners.

The latter point is a crucial part of high-quality accounting services. An expert accountant will be able to give general advice and guidance about the financial performance of your business as well as specialist advice, such as advice on business expansion, exporting, tax efficiency, etc. This advice will be based on an analysis of the financial performance of your business as well as the accountant’s knowledge of market trends, laws, regulations, and other factors that influence business ambitions.

Accounting Vs Bookkeeping Infographic

Accounting Vs Bookkeeping – Which Should You Choose?

There are many different ways you can handle both bookkeeping and accounting tasks in your business. For example, you can look after bookkeeping internally and then hire a Chartered Accountant for the accounting tasks.

The number one piece of advice, regardless of the approach you choose, is to take steps to make sure both are handled. Failing to keep up with bookkeeping tasks on a daily/weekly/monthly basis, for example, can lead to significant challenges, headaches, and costly mistakes down the road.

In terms of outsourcing bookkeeping and accounting, you can use separate services or a firm that provides both, i.e., all the services that traditionally come under both bookkeeping and accounting headings (and potentially more besides).

At Gilroy Gannon, we offer tailored services that can include just bookkeeping, just accounting, or a combination of the two. We also offer a broad range of other accounting and business support services. Get in touch with us today to discuss your requirements and get a quote.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.