Why Use a Chartered Accountant?

There are accountants, companies (and individuals) that provide accountancy-related services, and then there are Chartered Accountants. In Ireland, Chartered Accountants are regulated members of either Chartered Accountants Ireland or the Association of Chartered Certified Accountants. What differentiates a Chartered Accountant from others that provide accountancy services, and why should you use a Chartered Accountant?

More details are below, but here is a summary of the main differentiators between a Chartered Accountant and other types of accountancy services.

Chartered Accountants:

- Hold professional accreditation

- Are qualified

- Have broad experience

- Adhere to standards and follow guidance

- Comply with a code of ethics

- Offer specialist services and knowledge

- Are monitored by professional bodies

- Hold professional indemnity insurance

- Offer structured and regulated complaints procedures

- Are committed to continuous professional development

Chartered Accountants Hold Professional Accreditation

While there are some areas of accountancy where practitioners must be properly registered and qualified (an example is a practitioner signing off on statutory audits), anyone can establish an accountancy business. They don’t even need to be qualified or experienced.

Chartered Accountants, on the other hand, hold a globally recognised professional accreditation similar to other professions such as doctors or solicitors. This accreditation demonstrates a higher standard of service and professionalism, not least because of the comprehensive steps that must be taken to become a Chartered Accountant.

Chartered Accountants Are Qualified

Accountants must be qualified to obtain Chartered Accountant status. There are various routes that an accountant can take to become qualified, but a qualification is essential.

While a qualification in itself isn’t the only measurement of ability, it is better to trust your accounts and the finances of your business to accountants who are well-trained.

Chartered Accountants Have Broad Experience

Chartered Accountants also have to demonstrate a broad range of experience across different business sectors, types of companies, and types of clients. This accountancy and business experience improves the standard of service and quality of advice you receive.

Chartered Accountants Adhere to Standards and Follow Guidance

Chartered Accountants must commit to upholding the standards set out by their accrediting body, as well as following best practice guidance. The standards and guidance set by Chartered Accountants Ireland and the Association of Chartered Certified Accountants have been developed over decades and represent quality, professionalism, and integrity.

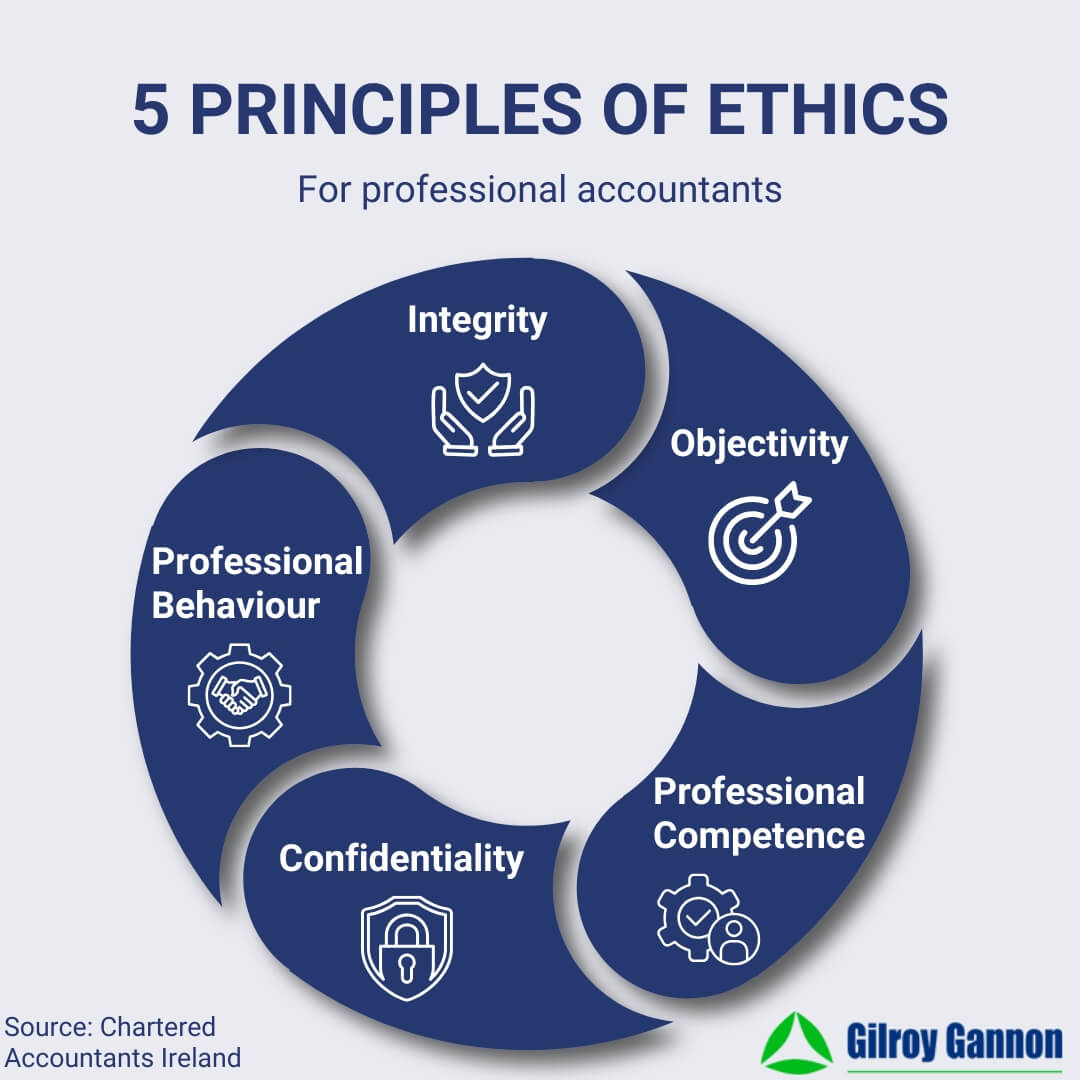

Chartered Accountants Comply with a Code of Ethics

Ethics is incredibly important in accountancy, so accrediting organisations also have codes of ethics that their members must follow. The codes cover everything from compliance and financial integrity to customer service standards and ethical business practices.

Chartered Accountants Offer Specialist Services and Knowledge

An unregulated accountant is likely to offer a limited range of services. The range of services and knowledge offered by Chartered Accountants, on the other hand, is extensive, as Chartered Accountants are better trained and have more experience.

You might not need the specialist services or knowledge right now, but a change in circumstances might make them essential. You don’t have to pay for specialist services if you don’t need them, but knowing they are available will reduce risks and give you peace of mind.

Professional Bodies Monitor the Performance of Chartered Accountants

Becoming a Chartered Accountant is only one stage of the journey, as ongoing compliance with standards, guidance, and codes of ethics is essential. Chartered Accountants are monitored by their accrediting body on everything from the delivery of services to compliance, procedures, and policies.

Chartered Accountants Hold Professional Indemnity Insurance

Professional indemnity insurance is a safety net to ensure you are protected if things go wrong. Holding professional indemnity insurance is part of the professional standards that Chartered Accountants must adhere to.

You Get Access to Complaints Procedures with a Chartered Accountant

You will have limited options available to make a complaint against an unregulated business or individual providing accountancy services. Complaints are handled in a much more structured way when you use a Chartered Accountant, as both Chartered Accountants Ireland and the Association of Chartered Certified Accountants have well-established complaints procedures you can use if required.

Chartered Accountants Are Committed to Continuous Professional Development

Continuous professional development is part of the commitment that accountants must make when becoming a Chartered Accountant. In fact, continuous improvement is a core principle.

Chartered Accountants will engage in continuous professional development in a number of ways. Those efforts are also supported by the professional bodies who provide guidance, training, information, and ongoing support.

Gilroy Gannon Chartered Accountants

We are proud to call ourselves Chartered Accountants at Gilroy Gannon and we strive every day to uphold the highest accountancy standards and principles. Members of our team are also active in the activities of both Chartered Accountants Ireland and the Association of Chartered Certified Accountants.

If you have any questions about the benefits of choosing a Chartered Accountant or want to discuss the requirements of your business, please get in touch.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.