The Difference Between a Merger, Joint Venture, and Acquisition

Mergers, joint ventures, and acquisitions are common corporate restructuring strategies for Irish businesses, large and small. What is the difference between each of the options, when are they most relevant, and what are the potential legal and regulatory issues that could be involved?

Businesses go through corporate restructuring processes for a range of reasons. Examples include expanding operations, becoming more competitive, or recovering from financial challenges. The objectives of owners, founders, and shareholders are also important considerations, with founder exit strategies, retirement realities, and shareholder investment returns frequently contributing to decision-making processes.

The following guide will outline the main differences between a merger, joint venture, and acquisition.

Merger

A merger is when two or more companies combine to create a new, single entity.

Mergers can take many forms. One of the most common is where the two previous companies cease to exist as they both become part of the new single entity. Another common approach is where one of the companies becomes a subsidiary of the other.

In the vast majority of situations, the operations, employees, resources, technologies, intellectual property, etc from both companies are combined in the new company.

The benefits of mergers include:

- The new combined company can become a more powerful player in the market because of the increase in size and scale of its operations, resources, and market share.

- When operating independently, the companies involved in the merger may have been competitors. Mergers reduce competition.

- The new single entity will benefit from the complementary strengths and expertise of both original companies.

- The new single entity can streamline costs and make efficiency savings.

Joint Venture

A joint venture is where two or more companies stay separate businesses but work together on a specific project in a partnership-style arrangement.

A separate business can be created to operate and manage the joint venture, or it can be established through contracts.

Importantly, a joint venture is more than a strategic partnership. In a strategic partnership, companies can also work together when their interests align. However, a joint venture is a more formal structure recognised in law contractually or through the creation of a new business where both companies share the risks and rewards.

The benefits of joint ventures include:

- The companies involved can share resources and expertise.

- Risks are shared across the companies involved.

- The costs are also shared across the companies involved.

- Each company retains full control over its business and operations.

- The structure can help businesses achieve key objectives, such as getting access to new markets, creating new commercial opportunities, or developing new technologies.

Acquisition

An acquisition is where a company buys and takes full control over another company.

Again, the final structure can take many forms. For example, the acquired company can cease to exist as it becomes fully part of the acquiring company. Another option is for the acquired company to continue to operate as part of a group where the acquiring company is the parent.

The benefits of acquisitions include:

- The acquiring company can eliminate competitors by buying businesses offering similar products or services.

- The acquiring company can obtain new assets such as intellectual property, technologies, or facilities.

- The acquiring company can increase its market share and/or expand into new markets.

- The acquiring company can add complementary services, products, and/or expertise.

- The acquiring company can get quick access to a new market or rapidly diversify its business.

- The company being acquired could achieve a successful and profitable exit strategy for its founders and investors.

- The company being acquired could also increase its growth potential as part of a larger group or recover from financial difficulties.

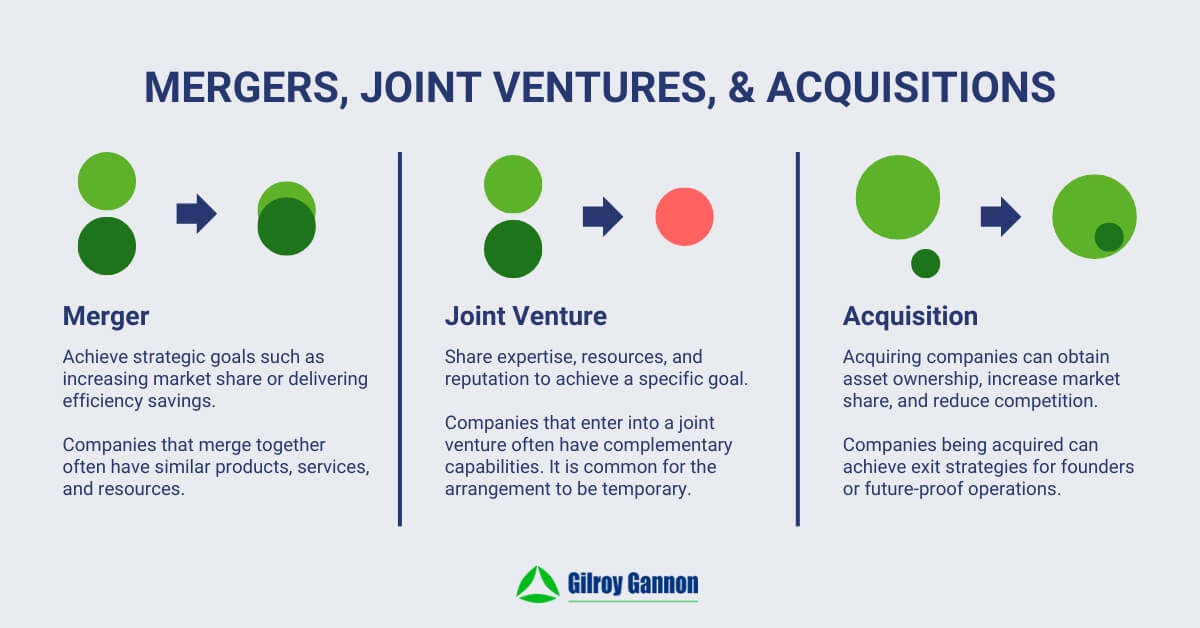

Merger, Joint Venture, and Acquisition Summary

- Merger – two or more companies combine into a single entity.

- Joint venture – two or more companies create a new business or contractual arrangement focused on a specific project or objective.

- Acquisition – where one company takes full control over another.

A Word on the Competition and Consumer Protection Commission

Under Irish law, some mergers and acquisitions need to be examined by the Competition and Consumer Protection Commission (CCPC). This includes any merger of media companies.

For companies in other industries, it depends on the turnover of the businesses involved. If the combined turnover of the companies involved in the previous financial year is more than €60m and the individual turnover of each company involved is more than €10m, the merger or acquisition will need to be examined by the CCPC.

In these situations, there is an obligation to notify the CCPC about the merger or acquisition. There are also situations where companies might decide to voluntarily notify the CCPC even when mandatory requirements are not met. The CCPC can also request notification when mandatory requirements are not met if it believes the merger or acquisition could damage competition or consumer protection in Ireland.

Supporting Corporate Restructuring in Your Business

At Gilroy Gannon, we have extensive experience providing support to businesses involved in mergers, acquisitions, and joint ventures. This includes both buy-side and sell-side advisory services, as well as management buy-outs, leveraged buyouts, and more. Get in touch to arrange a consultation with a member of our team.

Latest Blog

Check out our blog and you will get the latest news, events, and financial tips from Gilroy Gannon.